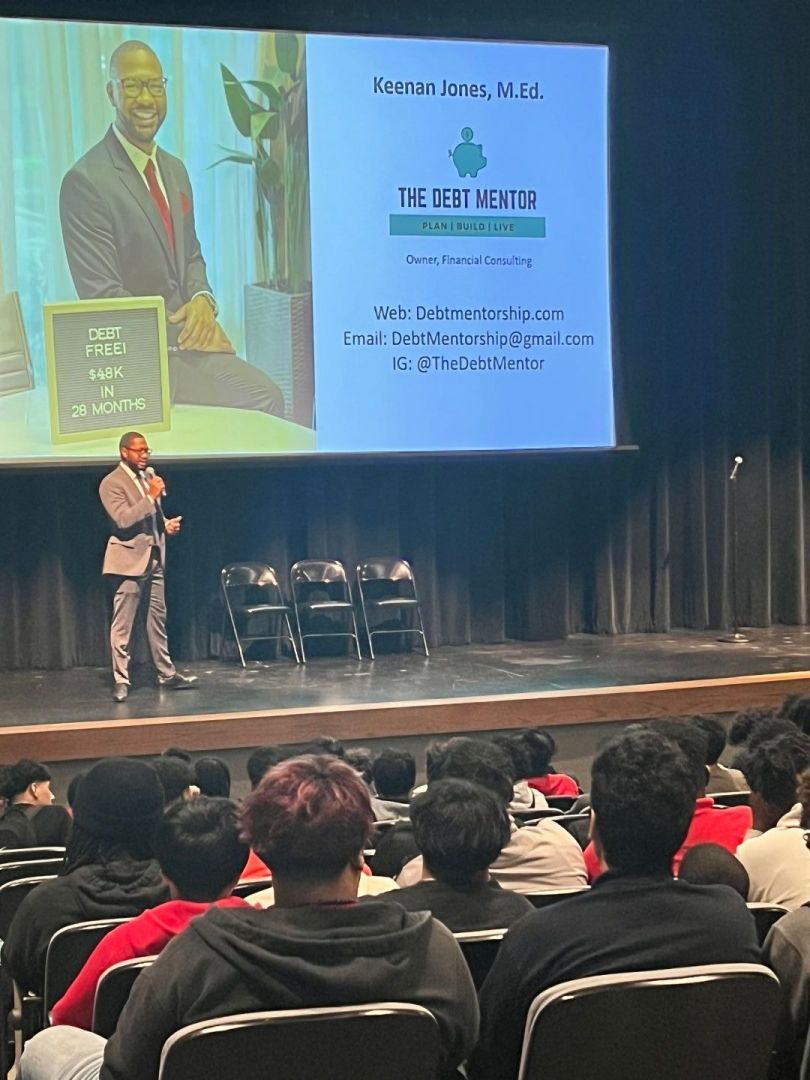

Meet Keenan Jones | Founder of The Debt Mentor

We had the good fortune of connecting with Keenan Jones and we’ve shared our conversation below.

Hi Keenan, can you walk us through the thought-process of starting your business?

The process of starting The Debt Mentor stemmed from a personal problem that only I could solve. I made some financial mistakes in my early adult life, which led to my growing debt ($48,000 to be exact!). Being in debt started to prevent me from enjoying the simple things in life, and I knew I needed to make a change. With research, a written plan, and discipline, I was able to pay off all my debt in 28 months (Jan. 2019 – April 2021). Throughout my journey, I gained a deeper understanding of personal finance and realized the importance of financial literacy. I’m passionate about making financial literacy fun, interactive, and relatable, which is why I launched The Debt Mentor. Learning how to make better financial decisions should be accessible and engaging. It doesn’t matter if you are in grade school, college, starting your career, or earning over 6 figures, I have something for you!

Can you give our readers an introduction to your business? Maybe you can share a bit about what you do and what sets you apart from others?

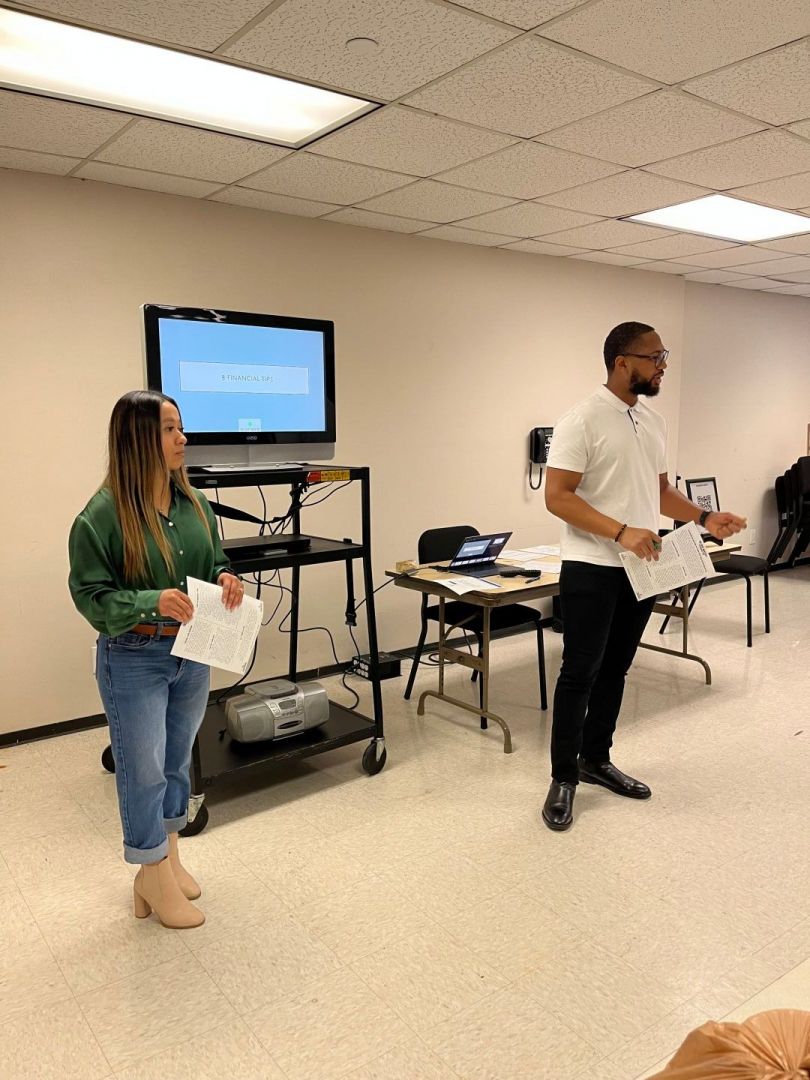

The Debt Mentor (TDM) focuses on three core areas of financial empowerment: debt management, budgeting, and smart money decisions. We provide 1:1 mentorship, group presentations, and 2+ day workshops (virtual and in-person). We work with individuals, local businesses looking to host an event for their customers/employees, and non-profits/school districts. We teach participants how to create a debt repayment plan, how to create a budget and stick to it, and how to have a positive relationship with money by making intentional decisions when it comes to spending. According to recent studies, nearly 80% of Americans are in debt and many struggle to make ends meet. TDM provides a solution to this problem by empowering people with the knowledge and tools to get out of debt and take control of their finances. Our clients’ demographic is diverse and has included: high school and college students, low-income individuals that earn $30k/year or less, married couples, and first-generation high earners- $100k/year and above.

Since launching in 2021, we have been involved in the Houston community, which is what sets us apart. Our 3 favorite community events are our Back-to-School Drive, Holiday Toy Drive, and Social Impact Partnership. TDM gave away 100+ backpacks filled with school supplies and financial literacy information to 50+ K-12 students, parents, and educators. We also raised over $2,200 to provide 10 students, 8 parents, and 4 teachers with a debt-free Christmas, and partnered with a non-profit aimed at ending human trafficking to offer free financial empowerment sessions to survivors. Overall, our goal has always been to make financial literacy accessible.

We always welcome new opportunities and/or partnerships to teach others how to make better financial decisions for themselves or their families.

If you had a friend visiting you, what are some of the local spots you’d want to take them around to?

Let’s start with food- Tacos A Go Go, Cascabel, Korny Vibes, Velvet Taco. Coffee shops- SlowPokes, A 2nd Cup, Brass Tacks, Agora. Outdoors/Relaxing- Memorial Park, Buffalo Bayou Park, Stude Park, NailTherapie HTX. Parts of town- Heights, Montrose, Uptown, Energy Corridor, Museum District.

Shoutout is all about shouting out others who you feel deserve additional recognition and exposure. Who would you like to shoutout?

Shoutout to my Wife, Yoali, for her support while I was on my debt-free journey- beginning in 2019. At the start of my journey, we were in our first year of dating. I knew I would ask for her hand in marriage one day, so I intentionally increased our conversations about our relationship with money and our financial goals. We would regularly have budget meetings, research tips and tricks, and provide emotional support when the financial road became bumpy. Now of course, I read books, listened to podcasts, and had conversations with friends/family, but nothing came close to my Wife’s support. As I mentioned, debt was preventing me from enjoying the simple things (vacations, dates, ownership), and I was blessed to have a partner that trusted the process. So blessed that I proposed the same year I became debt-free, 2021.

Website: https://www.debtmentorship.com

Instagram: @thedebtmentor